Fiscal Year 2025 General Fund Unaudited Revenues/ Sources as of September 22, 2025

Takeaways: Reminder that these are unaudited figures and are subject to change

- Property Tax was less than budget for the first time since Fiscal Year 2013

- We will look at the data to determine what, if any, P-Tax adjustments may be needed for estimates/forecasts

- C-Tax data continues to be incomplete and/or not accurate to use for forecasting

- Without $6.9 million of unrealized Gains (URG), Total Sources = $518,017,023

- Unrealized Gaines/(Losses) are not cash or spendable; they are reporting only

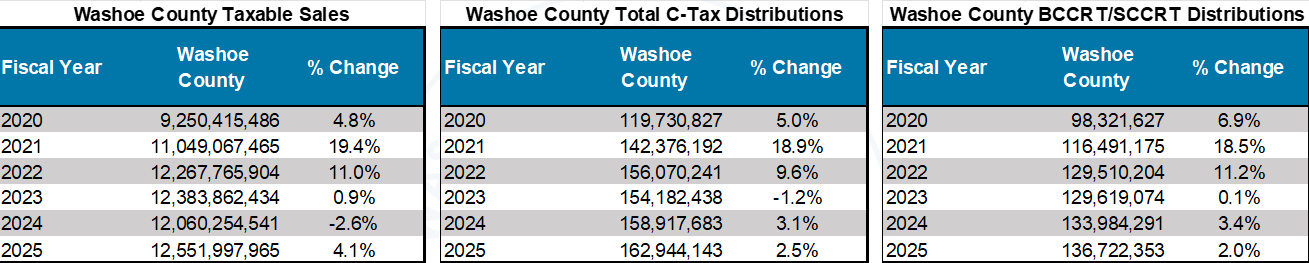

Fiscal Year 2025 General Fund Unaudited Consolidated Tax Distributions Through June 2025

* Note: Department of Taxation total Fiscal Year 2025 taxable sales data, through June 2025, became available September 22, 2025 ** Note: Washoe County reported taxable sales in Fiscal Years 2019 and 2020 were impacted by a negotiated Consolidated Tax (C-Tax) refund. The refund is reported as a negative taxable sale, thus impacting taxable sales in Fiscal Years 2019 & 2020. Adjusting for the negative taxable sales, the FY 2019 & 2020 respectively increases are approximately 6.6% and 4.98%.

Takeaways: Reminder that these are unaudited figures and are subject to change

- C-Tax data continues to be incomplete and/or insufficient to use for forecasting. This impacts the Fiscal Year 2026 estimates and the associated General Fund 5-Year Forecast.

- Department of Taxation total Fiscal Year 2025 taxable sales data, through June 2025, became available September 22, 2025. There’s not been enough time for reliable trend/other analysis.

- While reported taxable sales are up 4.1%, distributions are only up 2.5% (total) and 2.0% (BCCRT & SCCRT only)

- We have no data re: July 2025 taxable sales or C-Tax distribution

- Based on information from the Cities of Reno & Sparks, we could see a lower-than- anticipated July distribution.

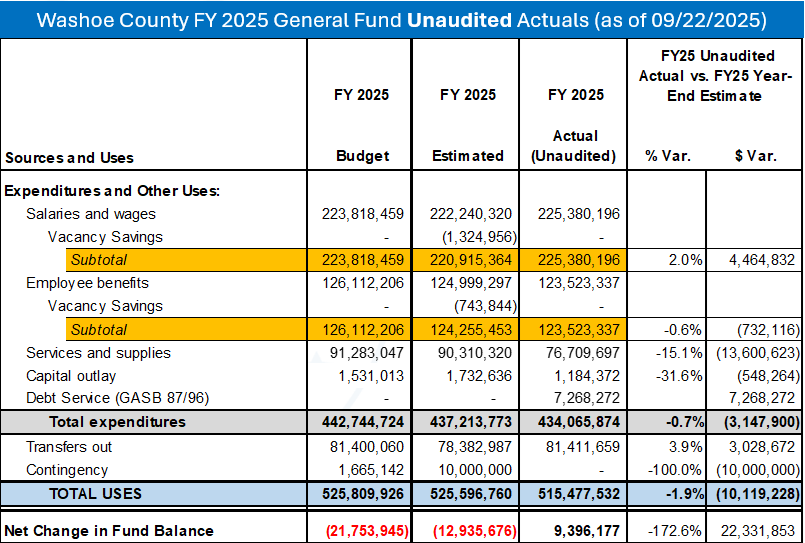

Fiscal Year 2025 General Fund Unaudited Expenditures/Uses as of September 22, 2025

Takeaways: Reminder that these are unaudited figures and are subject to change

- Net Change in Fund Balance is better than estimated BUT

- Without Unrealized Gains (URG), Net Change in Fund Balance = ~$2.5 million

- C-Tax data is incomplete and/or not accurate to use for forecasting

- Property Tax was less than budget for the first time since Fiscal Year 2013

- Forecast still needs to account for certain unbudgeted expenditures (i.e., SB116 Elected Officials’ Salary Increases)

- Without formal austerity measures, personnel expenditures reflect “natural” savings

- Pay Period #19 Personnel Cost Plan shows FY 2026 year-to-date salary savings of ~0.8%; which is on target for 3% annual savings BUT

- Does not reflect open enrollment changes

- Does not reflect potential overages of other pay types (i.e., overtime, standby pay, call back, termination payouts, etc.)

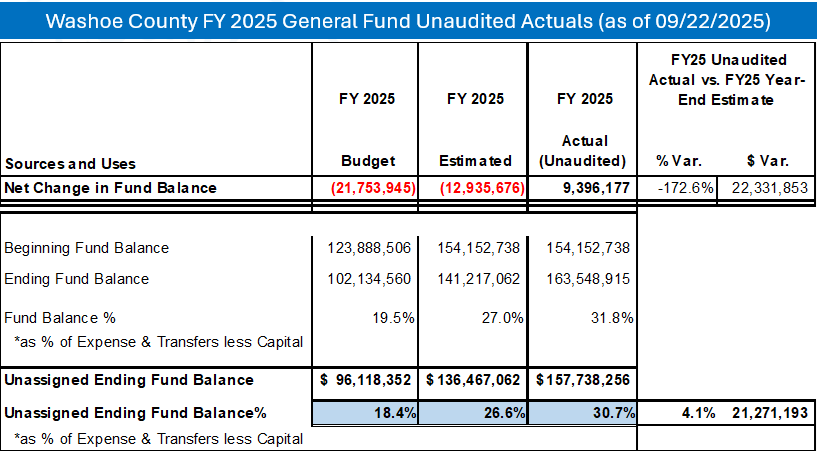

Fiscal Year 2025 General Fund Unaudited Fund Balance as of September 22, 2025

* Note: Unassigned Ending Fund Balance without URG and adjusted for carry forward = $150.9 million; 29.3%

Takeaways: Reminder that these are unaudited figures and are subject to change

- Net Change in FY 2025 Fund Balance is better than estimated BUT ongoing structural deficits are still anticipated

- Staff will likely recommend a cautious Fiscal Year 2027 budget message with an emphasis on one-time uses-including technology implementation and efficiency improvements. Adding positions will not be recommended due to fluctuating revenues and personnel costs escalating faster than revenue.